Copper etf 3x images are available in this site. Copper etf 3x are a topic that is being searched for and liked by netizens today. You can Find and Download the Copper etf 3x files here. Get all free vectors.

If you’re looking for copper etf 3x pictures information related to the copper etf 3x keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Plenty of commodity exchange-traded funds ETFs are on the market today including broad commodity funds as well as ETFs that track specific assets like energy metals and materials. It is designed to enable investors to gain a three times leveraged exposure to a total return investment in Copper futures. The Global X Copper Miners ETF which seeks to replicate the performance of the Solactive Global Copper Miners Index and the. The 4 Best Copper ETFs A copper ETF or exchange-traded fund is a simple cheap way to add exposure to this metal to your portfolio. There are 2 distinct copper ETFs that trade in the US.

Copper Etf 3x. Markets Copper ETFs have total assets under management of 13843M. It is designed to enable investors to gain a three times leveraged exposure to a total return investment in Copper futures. The average expense ratio is 063. Silver futures have dramatically outperformed the market in the past year with a 1.

Hbrirmkg7ttxqm From

Hbrirmkg7ttxqm From

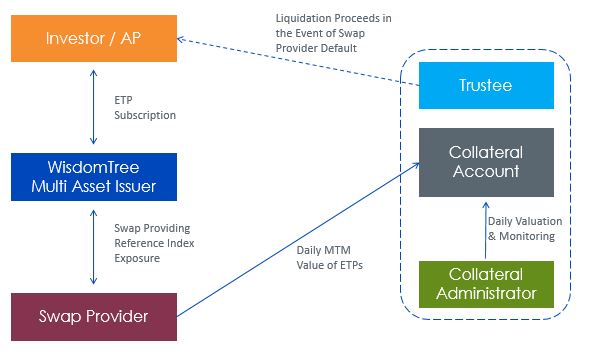

The average expense ratio is 063. The Global X Copper Miners ETF which seeks to replicate the performance of the Solactive Global Copper Miners Index and the. ETFS 3x Daily Long Copper is an Exchange Traded Commodity ETC. The silver ETF universe is comprised of 3 ETFs that trade in the US excluding inverse and leveraged ETFs. This is a list of all Leveraged 3X ETFs traded in the USA which are currently tagged by ETF Database. This ETF tracks copper performance as measured by the Solactive Global Copper Miners Total Return Index.

The fund tracks the Solactive Global Copper Miners Index which covers copper exploration companies developers.

The fund tracks the Solactive Global Copper Miners Index which covers copper exploration companies developers. Find the latest Global X Copper Miners ETF COPX stock quote history news and other vital information to help you with your stock trading and investing. If you want to browse ETFs with more flexible selection criteria visit our screenerTo see more information of the Leveraged Commodities ETFs click on one of the tabs above. Silver futures have dramatically outperformed the market in the past year with a 1. The Global X Copper Miners ETF is up 1192 percent year-to-date trading at US2260. ProShares ETFs are generally non-diversified and entail certain risks including risk associated with the use of derivatives swap agreements futures contracts and similar instruments imperfect benchmark correlation leverage and market price variance all of which can increase volatility and decrease performance.

Source: nasdaq.com

Source: nasdaq.com

Copper ETFs can be found in the following asset classes. The ETP provides a total return. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Copper relative to other commodities. Global X Copper Miners ETF. Its two largest holdings by market value are the China-based company Zijin Mining and the US-based company Freeport-McMoRan.

Source: seekingalpha.com

Source: seekingalpha.com

The fund tracks the Solactive Global Copper Miners Index which covers copper exploration companies developers. Please note that the list may not contain newly issued ETFs. The 4 Best Copper ETFs A copper ETF or exchange-traded fund is a simple cheap way to add exposure to this metal to your portfolio. Consider that as of mid-January the 15 billion ProShares UltraPro Short QQQ ETF SQQQ was second only to the 3335 billion SPDR SP 500 ETF Trust SPY in terms of 45-day average daily share. With 2 ETFs traded on the US.

Source: grizzle.com

Source: grizzle.com

The fund tracks the Solactive Global Copper Miners Index which covers copper exploration companies developers. The average expense ratio is 063. The ETP provides a total return. There are two copper mining ETFs that are popular with investors. ETFS 3x Daily Long Copper is an Exchange Traded Commodity ETC.

Source: nasdaq.com

Source: nasdaq.com

Copper prices have risen 400 over the past 12 months while the SP 500 has posted a total return of 208 as of February 2 2021. Whereas CPER holds no more than three copper futures contracts COPX invests directly in a range of copper mining companies around the world. The 4 Best Copper ETFs A copper ETF or exchange-traded fund is a simple cheap way to add exposure to this metal to your portfolio. Find the latest Global X Copper Miners ETF COPX stock quote history news and other vital information to help you with your stock trading and investing. Assets in thousands of US.

Source: wisdomtree.eu

Source: wisdomtree.eu

There are two copper mining ETFs that are popular with investors. The 4 Best Copper ETFs A copper ETF or exchange-traded fund is a simple cheap way to add exposure to this metal to your portfolio. Copper prices have risen 400 over the past 12 months while the SP 500 has posted a total return of 208 as of February 2 2021. This is a list of all Leveraged 3X ETFs traded in the USA which are currently tagged by ETF Database. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Copper Miners relative to other industries.

Source: pinterest.com

Source: pinterest.com

There are two copper mining ETFs that are popular with investors. ETFS 3x Daily Long Copper is an Exchange Traded Commodity ETC. Plenty of commodity exchange-traded funds ETFs are on the market today including broad commodity funds as well as ETFs that track specific assets like energy metals and materials. If youre looking for a more simplified way to browse and compare ETFs you may want to visit our ETFdb Categories which categorize every ETF in a single best fit category. Markets Copper ETFs have total assets under management of 13843M.

Source: br.pinterest.com

Source: br.pinterest.com

Copper ETFs can be found in the following asset classes. The 4 Best Copper ETFs A copper ETF or exchange-traded fund is a simple cheap way to add exposure to this metal to your portfolio. It is designed to enable investors to gain a three times leveraged exposure to a total return investment in Copper futures. This ETF tracks copper performance as measured by the Solactive Global Copper Miners Total Return Index. Assets in thousands of US.

Source:

Source:

The silver ETF universe is comprised of 3 ETFs that trade in the US excluding inverse and leveraged ETFs. Silver futures have dramatically outperformed the market in the past year with a 1. ProShares ETFs are generally non-diversified and entail certain risks including risk associated with the use of derivatives swap agreements futures contracts and similar instruments imperfect benchmark correlation leverage and market price variance all of which can increase volatility and decrease performance. This is a list of all Leveraged 3X ETFs traded in the USA which are currently tagged by ETF Database. This ETF tracks copper performance as measured by the Solactive Global Copper Miners Total Return Index.

Source: pinterest.com

Source: pinterest.com

ProShares ETFs are generally non-diversified and entail certain risks including risk associated with the use of derivatives swap agreements futures contracts and similar instruments imperfect benchmark correlation leverage and market price variance all of which can increase volatility and decrease performance. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Copper Miners relative to other industries. The ETP provides a total return. This is a list of all Leveraged 3X ETFs traded in the USA which are currently tagged by ETF Database. The Global X Copper Miners ETF is up 1192 percent year-to-date trading at US2260.

Source: in.pinterest.com

Source: in.pinterest.com

The Global X Copper Miners ETF is up 1192 percent year-to-date trading at US2260. The underlying index is designed to reflect the performance of a portfolio of copper futures contracts diversified across multiple maturities fully collateralized with 3-month US. There are two copper mining ETFs that are popular with investors. Consider that as of mid-January the 15 billion ProShares UltraPro Short QQQ ETF SQQQ was second only to the 3335 billion SPDR SP 500 ETF Trust SPY in terms of 45-day average daily share. The Boost Copper 3x Leverage Daily ETP aims to replicate the daily performance of the NASDAQ Commodity HG Copper Index ER multiplied by a leverage factor of three.

Source: in.pinterest.com

Source: in.pinterest.com

Markets Copper ETFs have total assets under management of 13843M. This ETF tracks copper performance as measured by the Solactive Global Copper Miners Total Return Index. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Copper Miners relative to other industries. Whereas CPER holds no more than three copper futures contracts COPX invests directly in a range of copper mining companies around the world. It is designed to enable investors to gain a three times leveraged exposure to a total return investment in Copper futures.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title copper etf 3x by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.